Armand here, RPost’s product evangelist armadillo. As I sit here and write from Tokyo, working with our RPost Japanese team, partners, and chatting about Ohtani-san (one of the LA Dodger’s greatest), I couldn’t help but put my macroeconomic hat back on.

In early March, before all this tariff talk, I wrote about the Gartner Hype Cycle for AI and how this was the (in my armadillo opinion) trigger for the market sell-off (revisit Hype Cycle AI blog). I followed up with a more detailed financial thought piece in April, mapping this to the opportunity for Intelligent Applications (which is what we are, here at RPost, as is Palantir and the new xAI combo with X f/k/a Twitter for example (revisit Intelligent Application blog)).

Since then, the market has gone down, down, up, down… You know the pain or enlightenment, depending on how you are playing it.

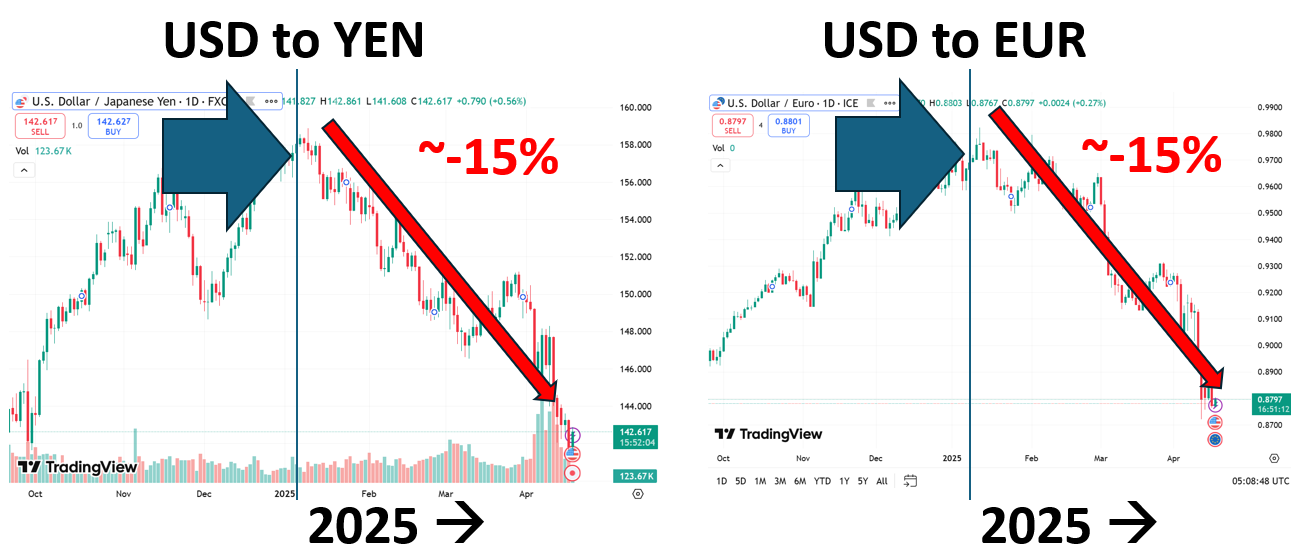

But it seems what very few are discussing is the impact of US Dollar devaluation. This impact is significant – we’ve gone from some of the strongest dollar-value days at year-end 2024 to a dramatic depreciation. And, my armadillo hypothesis is, this has been game-theorized into the US economic bring-back-exports and invest-in-USA strategies.

What is really happening macroeconomically speaking?

The dollar is getting cheap. Right now, for foreign investors or US multi-nationals with funds in EUR, GBP or YEN, or some other currencies, the US is on sale. Everything is 15% less expensive today compared to a few months ago. This should have a much greater favorable economic impact for the US economy and for adjusting the import-export imbalance, over and above any tariffs.

You see (and in summary), China, which is the 2nd largest US creditor after Japan, holds $750B in US Treasury securities. China is selling US Treasuries and converting the proceeds into German Bunds or Euros. And in Japan, private insurance companies hold tons of US Treasuries. As the Treasury value declines due to China selling, the Japan holders will sell US Treasuries to buy European fixed income. This will drive Treasuries down. And then, this will trigger further selling by the mega hedge funds being forced to unwind “bond basis trades” to avoid margin calls. All this will negatively impact demand for the US dollar and thus depreciate its value further. Expect further declines.

My prediction? We’ll near 100 YEN to Dollar days and there will be a party in Japan (for those looking to buy USA, but not for those looking to import INTO the USA!). Remember, in the 1970s, the YEN was at 300 and by 1995, the YEN hit 80 (1 dollar bought only 80 YEN) triggering the Japanese to buy real estate and companies galore across the USA. I digress.

Bottom line (in my humble armadillo opinion): people will scream that the US is losing value, as the dollar drops. But the dollar value drop will fuel investment in the US markets and US shipped goods.

As the dollar value drops vis a vis foreign currencies, and if those in these foreign lands are also forced to drop tariffs of US goods imported, you will have a massive uplift in purchase power of foreigners of US exported physical products, intellectual property products (e.g., software and related software services), speculative products (stocks on US dollar denominated markets), and human capital (US companies investing in US-based dollar-denominated labor versus foreign labor).

This should in turn (at some point in 2025) create a massive boom for the US economy; so long US-based dollar-spending folks are not looking to buy property, vacation, or invest in human capital overseas. They will stay put in the USA and keep their dollars in the USA.

Now, what does this mean from an RPost perspective?

We're a global company, so we will likely re-invest our foreign currency revenues into the US market (we get 15% more value for every dollar purchased with our EUR, YEN, GBP if re-invested into the USA; and this “discount” may go up (from December 2024 highs).

We will also encourage all the CIOs who we met in Europe and Asia over the last weeks to lock in long-term contracts of RPost eSecurity and eSignatures, as for them, it’s like having a 15% across-the-board sale on RPost products.

But don't worry, even with this anticipated spike in demand for RPost products from international buyers, for all our US customers and potentials, we'll keep our products very affordable, and you'll continue to enjoy feature-rich, innovative, AI-infused, more secure RPost products provided by friendlier people.

We're here for you. Wherever you are.

February 20, 2026

.jpg)

February 13, 2026

February 06, 2026

January 30, 2026

January 23, 2026